(Lieber Bootstrapping.Me Leser, diesmal auf Englisch. Bei 3.586 Worten schaffe ich es gerade nicht, die Geschichte auch auf Deutsch zu erzählen.)

What you will read and learn in this article

- Background story, how we came up with the idea and concept for a Venture Capital Private Security Token Offering

- Our experiences with security tokens and venture capital regulations in Europe

- Our efforts in building a digital platform to create a seamless investment process for a closed asset class venture capital

- My personal view on Tokens, ICOs and Venture Capital fundraising

Disclaimer: I do not provide any legal, taxation or financial advice. This article is based on real-life experiences and is based on my personal opinion. I am not inviting you to invest in ICOs or Token Offerings. Please always do your own due diligence.

Background Story

I’ve been active in the digital industry based in Berlin for the past 10 years. During this time I have been involved in companies like Delivery Hero (IPO 2017), Team Europe, Hitfox Group, Finleap (all Company Builders), Point Nine (Venture Capital) and more than 30 portfolio companies.

I personally own Bitcoins and later added other coins (e.g. ETH, IOTA, AGI, DASH, EOS, NANO, LSK, ADA, ZEC) since 2015/2016.

In late 2014 I started Asgard, a Venture Capital firm focused purely on Artificial Intelligence companies.

Since then, we have invested in deep tech AI companies like Micropsi Industries, Accelerated Dynamics or Parlamind.

In addition to my duties at Asgard, I am also involved with organizing the Rise of AI conferences, advising German Parliament, European Commission, foreign & defense ministries on international AI strategies, as well as publishing the Global, European and German Artificial Intelligence landscape.

The Idea for a Venture Capital Token Offering

In early 2017, I became aware of the small but growing ICO — Initial Coin Offering — trend of ICOs. First I observed the trend, then I started to invest in some ICOs, as well.

From the beginning I was fascinated by the concept, that all the information is shared, details on the team are transparent and there are clear terms and a roadmap. It is the beauty of the global internet, that startups now could raise capital in a decentralized environment and without a middle man (in theory). For investors, the convenience increased as well. You can invest in promising teams, without flying, travelling or calling. Given the information, the clear timelines and terms, you can make your own opinion and decide if you like to invest or not without interacting with a single person.

I write this, because there was a peaceful time before the hype. When startups, working on Blockchain technologies, used ICOs as a mean of funding. Before ICOs became overhyped and greed destroyed the beauty of the idea. At the beginning there were the core believers and innovators. Enthusiasts with a mission and technical expertise. Today we have an ICO market driven by a majority of companies believing in the quick cash, not realizing they are digging a grave for their investors.

Back to the story. In the meantime, after having invested in the first AI companies and supporting them for more than a year, we learned that AI investment take significant more capital and patience. True AI companies are research heavy. There is a lot of data gathering, cleaning of unstructured data, applying frameworks and training models. AI is not easy to execute but takes time and many trials.

Therefore the usual readiness for a Series-A (product market fit) took, on average, 2 years to reach and is significant slower (and more expensive) than the in past waves of ecommerce, lead generation, marketplaces and mobile.

We already had a strong deal flow of 600 AIs companies per year and a database of 7,500 potential investments. Therefore we thought it was time to raise a second Asgard fund. This time not only with our own capital, but open to external investors too.

We aim to have more capital to support new and existing AI companies, as well as expose more investors to Artificial Intelligence – the most important technology of our generation.

Having this in mind, I kept working on our portfolio until August 2017. Then, at an AI conference, I connected with someone via twitter, who asked me what I think about ICOs for Venture Capital. We met and discussed the idea for the following days. On this day, I realized that we are onto something. The core idea was born, even it is different than what we have today.

Our motivation and logic behind it

First, you should understand how fundraising for Venture Capital firms normally works. It is quite different than typical fundraising for startups — and way more difficult.

In the most digital ecosystems, it is easy to receive funding for your idea and seed phase. There is an abundance of governmental programs, scholarships, incubators, accelerators, business angels, crowdfunding, early stage VCs, corporate VCs and strategic partners. Nothing like this exists for Venture Capital firms.

The standard investor in a VC firm is called Limited Partner (LP). Those are often financial companies like pension funds, insurance firms and banks. There are also professional investors like fund-of-funds, wealthy individuals, family offices and sovereignty funds.

These LPs have a few things in common: They are usually risk-averse average white American males who work in the financial industry, don’t have a linkedin profile, and aren’t digital natives.

Sure, there are newer and more open LPs out there, however raising funds for a VC is like having a startup in the mid 2000s. The funding market is small and closed. And there is no competition amongst LPs.

Furthermore, we faced two more challenges. On the one hand, we are a first-time fund and LPs don’t like newcomers. It is like you only get funding for your startup, once you already have sold one before. There’s little chance to receive funding if you had never received capital before. This is one of the main reasons why many VCs are either launched by a financial professional (who have worked with capital before) or spun off from existing VC firms.

On the other hand we invest in Artificial Intelligence. A well-known and influential LP told me once “We don’t believe in AI. Do ecommerce instead!”.

So those challenges make fundraising amongst standard LPs even more difficulter than usual.

Additionally, you should know that fundraising takes up to 2 years before you see any money. That means you have to pre-finance the salaries of your team, legal work and expenses. Starting a VC firm can costs easily up to 1.5M €, which you have to pay out of your pocket before the fund is raised.

Honestly, I was pissed. After meeting several potential LPs over the year, I got the feeling that the market is years behind in terms of trends and technology.

Therefore I thought about combining digital fundraising (like the true ICOs) with Venture Capital for real. At least I wanted to figure it out if it could work.

The advantages were clear for me:

- Having access to a global investor base. Allowing LPs and new investors into the fund from everywhere. Allowing many to have a share of our portfolio companies that, we feel, will change everyone’s life.

- A seamless, transparent and quick investment process. No paperwork, fewer lawyers, and less contract work. If you want to become and investor, it should be possible within 24 hours.

- Reduction of administration and legal costs. Standardizing Venture Capital fundraising and forwarding this advantage to investors for saving time and costs.

For sure, we were also aware of the challenges

- Tokens are a new concept. They have to be explained.

- There is no proof of concept. In the summer of 2017, no one had tried to securitize Venture Capital in a legal framework.

- There are no service companies that have any experience with the concept.

- There is no best-practice and we could not learn from others.

- The regulation is unclear and we did not know if we were even allowed to do it.

The concept

After making the decision in September 2017 to raise our next fund we started to work on the concept. We knew we would need:

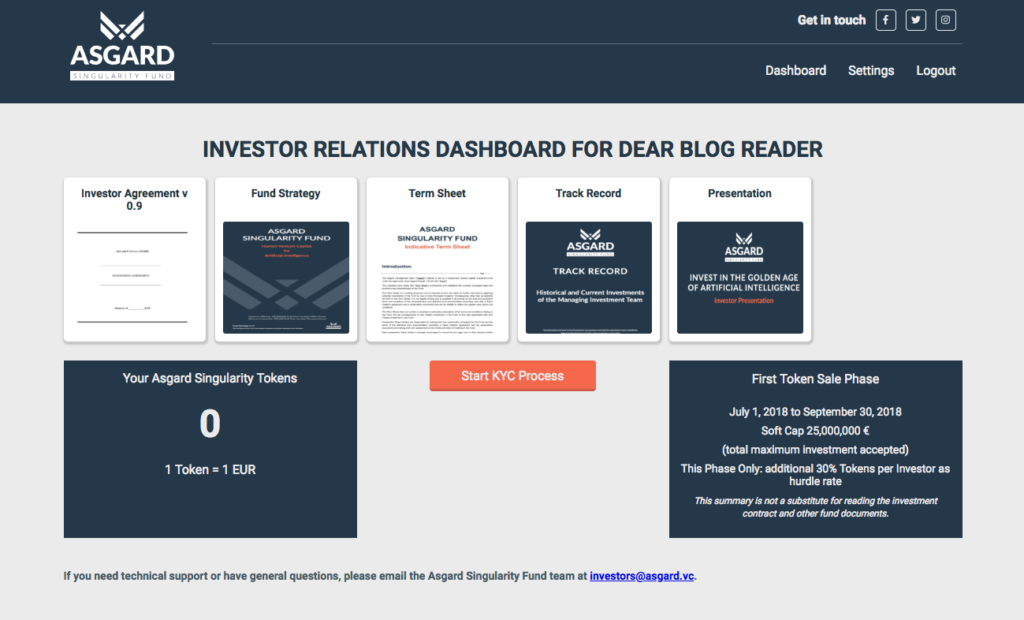

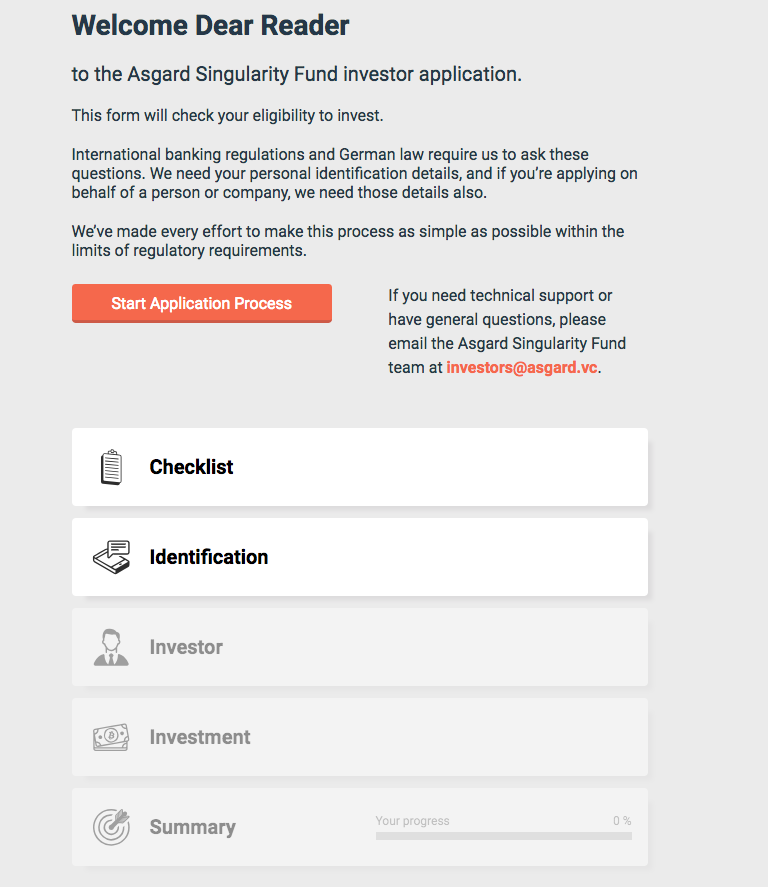

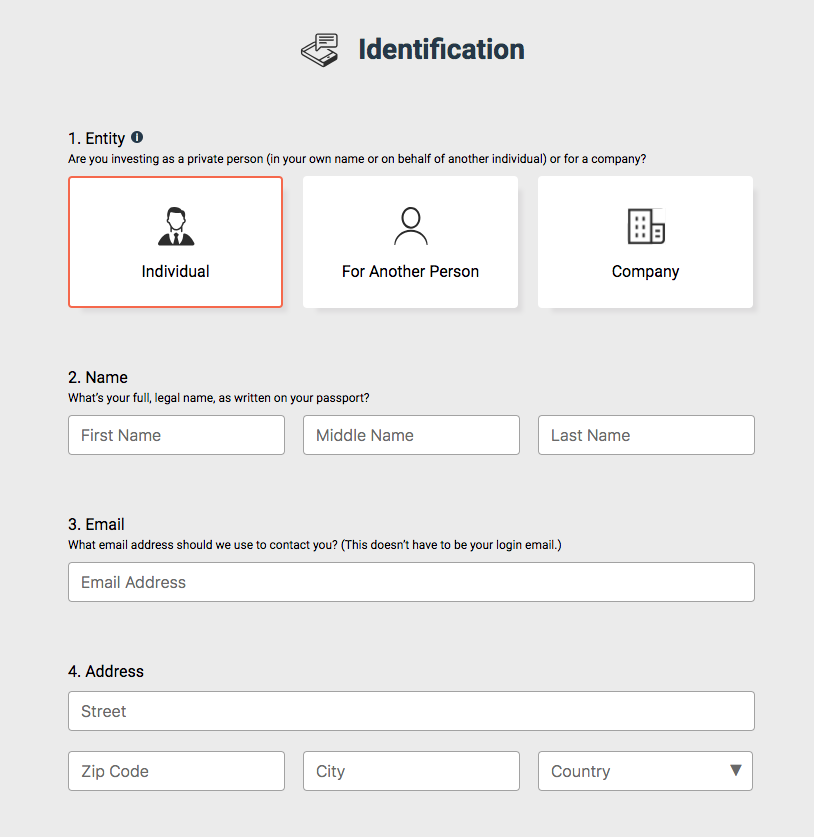

- A digital platform for Know-Your-Customer (KYC), Anti-Money-Laundry (AML) for an investment process that can scale.

- Support with fundraising, sales and marketing.

- Legal advice how to set up a structure and comply with regulation.

- A roadmap, a plan, budget and a larger team.

As usual I started to talk with people. There were few people out there who had any ICO experience and no one had done digital fundraising + VC before. Nevertheless, many were optimistic and believe that it might work.

The Regulation

The next step was to figure out the state of regulation.

I asked myself and my network: if this is legal, why has nobody done it before?

Today I know, that most VCs are not entrepreneurs. And it’s entrepreneurs who take risks, go for unknown markets and build new products against all odds.

Via my network, I was introduced to a young, but experienced law company that specializes in Venture Capital firms. They already knew my work as a VC and we had a great kick of meeting.

Together we started to discuss the concept and soon it become clear: yes, that all is legal. We stopped calling it an ICO and understood that we were working on a Token Sale. And this Token Sale would be possible in Germany, however under many conditions.

Soon we started to draft the concept and discussed it with the BaFin (Germany’s version of the SEC). The supervising authorities have been positively open and willing to learn. They did not give us a red light, which is the German way for “keep on going what you are doing.”

So what are the legal constraints to tokenize a Venture Capital firm in Germany (and therefore also Europe)?

Since we are not a public fund (which is even more highly regulated, take years to setup and are really no joy), we kept our legal structure as an specialized alternative investment fund (AIF) under European EuVECA.

We also had to accept that only semi-professional and professional investors with a minimum investment of 200,000 EUR can invest. We had to swallow this pill because within Europe (and USA) there would be no way around it.

We also learned, that we can accept any form of currencies (like BTC and ETH) as well, however the fund had to be nominated in Euro.

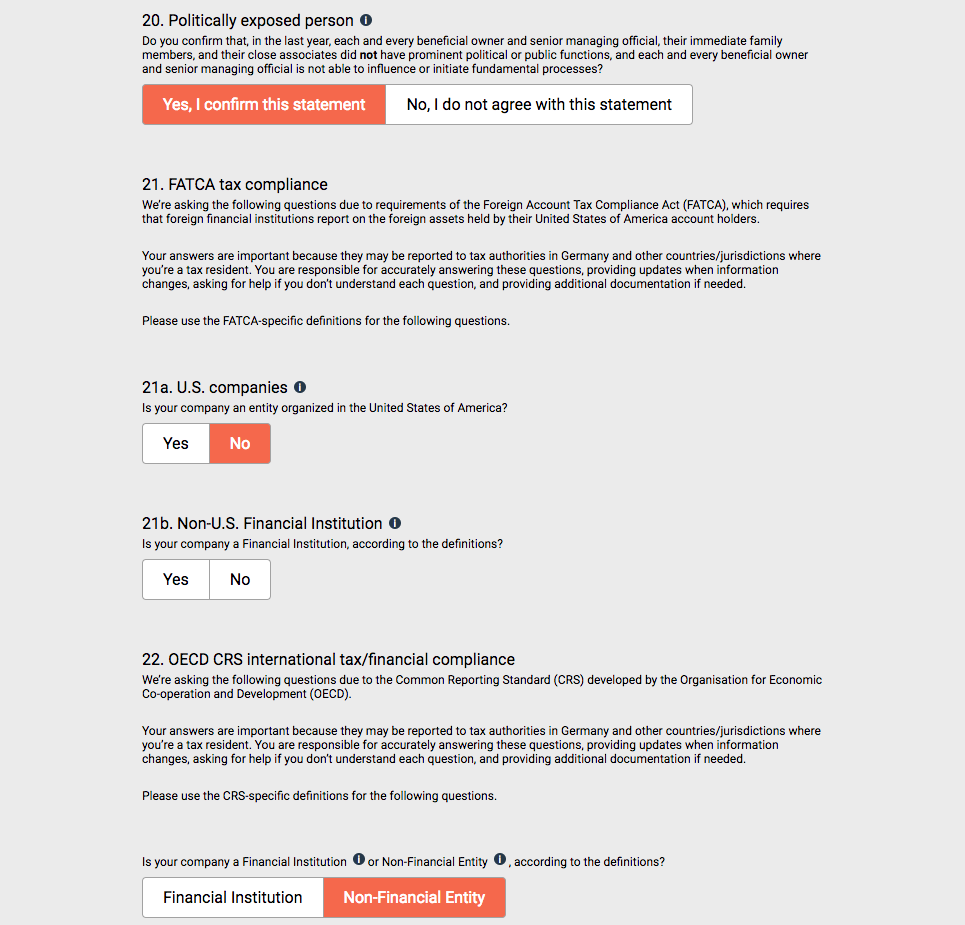

We also had to fulfill all obligations of GWG, KAGB, including a highly complex and detailed KYC, AML plus FATCA and OECD CRS. I tell you, that there is a lot of regulations and not an easy task.

We, the people, love crypto currencies because the government does everything possible to stay in control of the global financial flow.

We at least did not need a permit or anything formal. The German law allows tokenized Venture Capital. You just have to find the right law and apply it. That is what we did.

At this moment, it became clear to us that we could execute our plan. And with every plan, there comes more hurdles, legal constraints and setbacks. That is the usual entrepreneurial journey.

Building a team

We could not do it alone. Our existing Asgard team specialized on AI investments. It had no experiences with Tokens, regulations and platform development.

The guy I had talked with during the conference wanted to help. However he pulled out of the deal. He didn’t believe he could do it.

So I started from scratch. Again I asked my network and got introduced to many people. It was autumn 2017 and the ICO industry was exploding.

No one had any ideas. Everyone was new in the business. Very few Germans had been involved in token raising before.

Not a single contact had combined VC + Tokens.

Greed was everywhere. Prices were becoming insane. For legal advice the waiting list in Switzerland was 6 months. ICO agencies popped up everywhere and demanded 500,000 € in upfront payments. Everyone become ICO advisors overnight and were asking for 8,000 € monthly retainer plus 5% in tokens.

I mean, that was the wild west. All those gamers, gamblers, SEO agencies and day traders moved into the crypto market. They were in earlier before the professional players started to take over the game.

For our team, that meant I had to do the project management myself.

On the legal side, I had an amazing law company that was supportive but also had no previous experience with Tokens.

Google helped me to find a Blockchain development company in Berlin. They asked for double that price that is usually charged for web development, but at least had free capacity to work with us.

I also met Marcel, who helped with the first marketing, website development and whitepaper.

And then I met Carly (Dr. Carly E. Howard, LLM). Carly is the best addition to our team and a huge driver for this company. With her background as lawyer, being an American optimist, her entrepreneurial energy and work experiences in wealth management, she is the perfect fit for Asgard.

Overall I can say, that 3 people work full-time for the Token Sale for a year and over 20 partners, freelancers and service providers are involved as well.

Budget

Sharing financial numbers is always tricky. Let me try to be honest.

Two similar projects, which emerged in parallel (as tokenized VCs), have paid between 1M $ and 2.5M $ in legal set up costs before they raised their funds.

And since since VCs don’t raise money to cover costs (like a startups), every dollar going to lawyers and advisors, are dollars missing to invest in amazing companies.

You can calculate that legal advice will cost you between 200k € and 1.5M €, depending on how fast you need a solution and in what regulation you will operate your tokenized Venture Capital firm.

Building a platform for KYC, AML and investment process can be between 100k € and 500k € for frontend, backend and Blockchain development.

Marketing & Sales is open end. It can be low as 50k € for travel costs, networking and conferences, up to several millions for advisors, placement agents and PR agencies.

Furthermore you have to consider costs for the creation of documents like the Private Placement Memorandum (PPM), the Limited Partner Agreement (LPA), the Whitepaper or Fund Concept and more.

If you have started a company, you know that bootstrapping is not easy. Bootstrapping a VC? That is super hard. I am in the comfortable position because I have sold shares of prior investments before. However there is no way to start a Venture Capital firm, without having experience, network and capital already at hand.

Timing and communication

September 2017 I started with the idea. October and November I spent on team building. December 2017 I wanted to go live. Sounds ambitious? Yeah, it was. Nevertheless we were able to build a landing page (www.token.asgard.vc) and started to talk about the fund.

Later we went fully live 01.07.2018 with everything we needed. We had a soft launch a few weeks before to test the system, however there were delays from my original plan. Why?

First legal takes forever. Although we work with highly professional lawyers, it takes months to draft contracts. Especially because no European VC fund has been tokenized before, you have to find legal solutions for situations that have never been solved before.

Our investment contract is based on standard VC market terms, and, at the same time, extremely customized for the dynamics of a Token Sale.

Second, building the investment platform, itself, was not as straightforward as I thought. Digitalizing the fundraising process was a challenge.

Normally you receive 70 pages of complex, lawyers-English, legal paperwork, just as a subscription form. That means the 70 pages to collect your personal information and process it. That is not even the final contract, but only the step before it.

Therefore, our goal was to reduce those 70 pages to a 20 question digital form, so that instead of reading and asking your lawyers what those 70 pages mean, we wanted to make it easy, quick and understandable. We aimed to collect the same information within 10 minutes instead of weeks.

Well, we almost achieved it. Truthfully, it takes around 15 to 20 minutes to pass our investment process and there can be up to 23 questions, if you are an US based financial institute (which most of you are not).

Developing the concept, reducing complexity, designing the process, creating something new and beautiful took us 50% of the time. The other 50% included testing, bug fixing and usability improvements. We spent weeks just optimizing the user experiences. We hired external white hat hackers for penetration tests. We had to solve new security concepts for collecting data, storing it, working with it and verifying identities, as well as digital transactions.

As a side effect our communication was low. You can’t work on PR and brand building, if you are trying to build digital fundraising process. Either you work, or you talk.

Nevertheless we started to meet with potential investors beginning in January 2018. Even though we were not ready to onboard them, we asked them for feedback. That was an MVP (minimum viable product) for me. Speaking with investors, collecting their questions and demands. It was flowing directly into our story, documents, concept and technology.

Over the time we changed and started to avoid anything connected with ICOs. As I mentioned, the ICO market had turned bad and was now full of companies that either were not able to raise normal rounds, or were trying to exploit amateurs investors. Neither scam nor fraud is something we support or accept. It is sad that the ICO market did not find a quick solution to provide more investor protection and security. However, we learned a lot from this and implemented even more investor’s rights, data security and transparency to our fund.

Over time, we also learned that we were working on something, which is called a security token. You can name it a private security token offering for Venture Capital. That is what we are doing. Our security token is asset backed with existing and future portfolio companies.

Asgard is a fully registered Venture Capital firm regulated by BaFin. In order to be acknowledged by traditional investors as the successful, serious firm we indeed are, we had to put much distance between us and the flashy ICO crowd. Not that we were ever in that crowd anyway, but when we first started promoting our private security token sale, some funds turned away immediately, assuming anything with the word „token“ must be a scammy ICO.

It took much patience and a willingness to educate in order to launch our new VC token concept. (Which, in just the last few months, has become a commonly-discussed idea that blockchain industry experts all over the world want to see come to fruition.) Eventually, we found acceptance by both the ICO crowd and traditional investors, bringing both together to invest in solid AI companies.

At the end of the day, that’s what we’re all about. Asgard invests in Europe’s most promising Artificial Intelligence startups. Don’t let the token distract you, we eat, sleep and breathe AI. We’re using a VC token and launching a digital platform for VC because this advanced technology is available and we’re tech-forward thinkers. Why wouldn’t we bring the best process possible/available to our investors and portfolio companies? Why would we do this the old way, the cumbersome way, with mountains of paperwork and hefty lawyers fees, complicated questionnaires, and terms/definitions no one really understands?

That being said, security is of the utmost importance. We consistently walk the line to make our process easy to understand while still compliant, legally sound and secure.

Our middle ground is that we’ve created a safe, compliant, easy investment process you can click through. We offer an understandable fund strategy, not a whitepaper full of marketing nonsense but not an eye-crossing private placement memorandum either. Our contracts, while readable, have standard VCs terms and execute perfectly.

What I learned until today and I like to share

There is no incentive of any government out there to provide easier access to hard-to-get-in asset classes like Venture Capital, Private Equity or Hedge Funds. Everyone can invest in Startups and ICOs, but only the wealthy ones are allowed to become even wealthier through fund investments. I mean, having a stake in a VC firm is risky, but less risky than buying shares of a random ICO out there.

I mean, who of you had the opportunity to invest in Amazon, Facebook, Google or Delivery Hero before they went public? Only early business angels, the founders and funds (from Venture Capital to Growth Capital) ate all the pie, before you got the crumbles to pick up.

Furthermore our Token is not a unique selling argument. It rather creates questions, since few have any experiences with Tokens at all. If investors don’t know it, they don’t do it. Kind of a vicious circle.

Nevertheless we feel confident, that your digital investment process will have a long term impact on the industry. Others will follow us and move the innovation needle further ahead.

For me, so far it was an exhausting time but also brought me plenty of joy. It is great to work on something new and I don’t mind the risk. I am also thankful for my supportive wife, who seldom sees me and has to live with me being under contestant pressure.

If you like to learn more, just visit www.token.asgard.vc and join the Golden Age of Artificial Intelligence.